Imagine driving through Clermont on a sunny afternoon. But then out of nowhere, a driver turns across your lane. You brake hard but its too late now. The next thing you know, you’re on the ground, the bike’s on its side, and paramedics are asking if you can move your legs or not.

Hours later, reality hits. It is not just the pain. There are stacks of medical bills waiting for you. ER visits, scans, therapy. You call your motorcycle insurance company assuming it’ll handle everything. But the answer you get surprises most riders in Florida: your policy may not cover your own medical bills at all.

Our Florida personal injury attorneys at MANGAL, PLLC explain how motorcycle insurance works after a crash and what you can do to make sure your medical care is actually covered.

Why standard motorcycle insurance may not handle your medical bills

Florida treats motorcycles differently from cars when it comes to insurance. Most people assume their bike policy includes the same protection as car insurance especially the personal injury protection (PIP) that pays medical expenses. The catch is: PIP doesn’t apply to motorcycles in Florida.

That means if you’re hurt while riding, your insurance might cover other people’s injuries or property damage. It will not cover your own hospital bills. Unless you bought extra coverage — like “medical payments” or “MedPay” — you could be left paying out of pocket.

Many riders don’t realize this until after an accident. The policy language looks familiar, but the benefits are very different. Florida’s no-fault system simply doesn’t extend to motorcycles, even if you already have car insurance with PIP.

So when you’re reviewing your motorcycle policy, look beyond the premium. Check exactly what’s covered — and more importantly, what isn’t or speak to one of our experts for guidance.

What kinds of insurance can cover medical expenses for motorcyclists

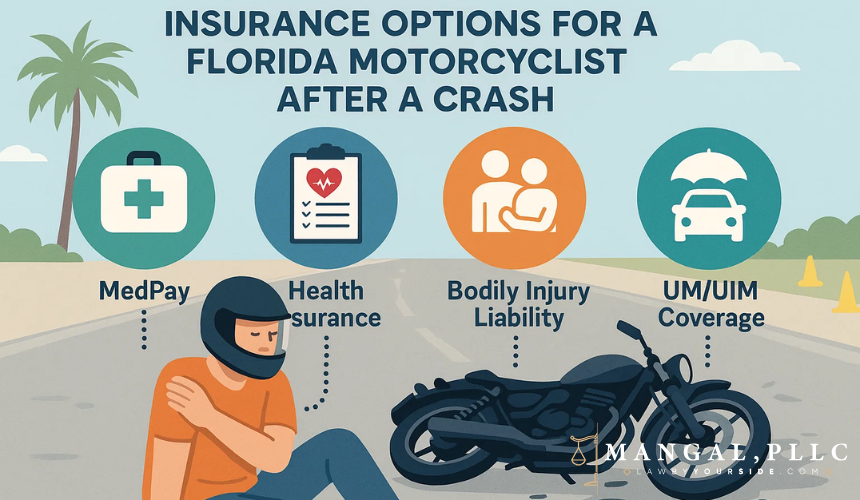

While basic motorcycle coverage might not include your own injuries, there are still several ways to handle medical costs after a crash:

- Medical Payments (MedPay) coverage: An optional add-on to your motorcycle policy that pays for your medical bills up to the limit, no matter who caused the crash.

- Health insurance: Your personal or employer-provided health plan can step in, but expect co-pays, deductibles, and possible reimbursement claims later.

- The at-fault driver’s Bodily Injury Liability (BIL): If another driver caused your crash, their insurance may be responsible for your medical bills, though this often requires a legal claim or settlement.

- Uninsured/Underinsured Motorist (UM/UIM) coverage: Protects you if the driver who hit you has no insurance or too little. Many Florida riders skip this and regret it later.

A single policy rarely covers everything. Most real-world cases involve a mix of these coverages and sometimes none, if the rider never added MedPay or UM/UIM. Knowing where to look and how to file claims under multiple policies can make the difference between full recovery and overwhelming debt.

What Florida law requires (and doesn’t require) for motorcyclists

Florida’s insurance laws are friendly to car drivers but are not friendly to riders. Car owners must carry Personal Injury Protection (PIP) coverage. It helps automatically pays medical bills after an accident. But motorcycles are completely excluded from that system.

If you own a motorcycle in Florida, you’re not required by law to carry any medical coverage for yourself. That means after an accident, your insurer isn’t obligated to pay your hospital or rehab costs unless you added specific coverage.

For riders over 21 who choose to ride without a helmet, state law does require proof of at least $10,000 in medical benefits coverage — but that can be satisfied by health insurance, not necessarily through your motorcycle policy. It’s a legal technicality many riders misunderstand.

In short: Florida doesn’t protect bikers automatically. You have to protect yourself through your own policy choices.

How to protect yourself — five smart steps after a motorcycle crash

When a crash happens, your medical bills and insurance coverage start moving in opposite directions. You can’t control what the other driver did, but you can control your next steps.

1. Get medical help immediately. Even minor crashes can cause serious internal injuries. Get checked out at the ER or urgent care the same day.

2. Save every document. Hospital discharge papers, X-rays, prescriptions, tow receipts — everything counts later.

3. Notify both insurers. Report the crash to your motorcycle insurer and, if another driver was involved, to their insurance company too. Don’t give recorded statements until you’ve spoken with a lawyer.

4. Ask about MedPay and UM/UIM coverage. These are the most common ways riders pay for medical care when they’re not at fault.

5. Talk to a Florida motorcycle accident attorney early. An attorney can trace every possible insurance source, deal with lien holders, and make sure your health insurer doesn’t take more than it should.

The right steps in the first few days protect your body — and your bank account.

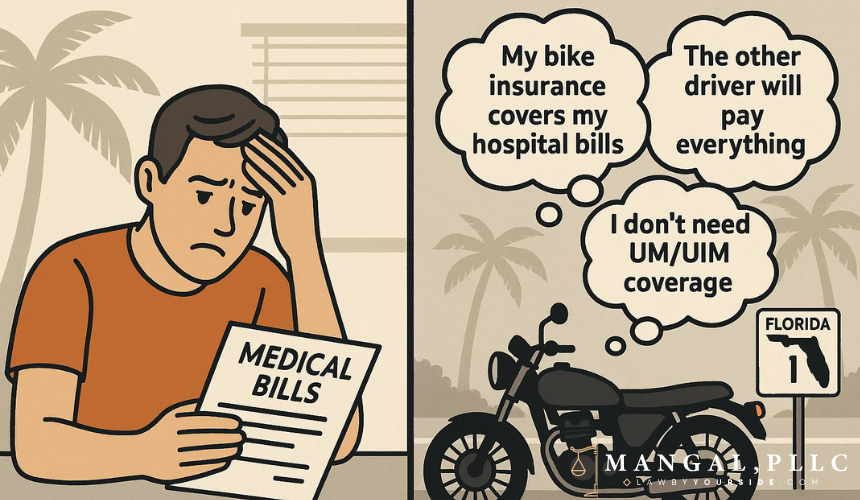

Common misunderstandings that cost riders money

Motorcycle insurance isn’t as straightforward as car coverage, and many riders find out too late that their assumptions were wrong.

- “My bike insurance covers my hospital bills automatically.” Not unless you added MedPay or have strong health insurance. Standard motorcycle liability policies don’t cover your own injuries.

- “If I wasn’t wearing a helmet, I can’t recover.” Not true. Helmet use can affect your injury severity and potential damages, but it doesn’t erase your right to compensation.

- “The other driver’s insurance will pay everything.” Maybe — if they’re insured, admit fault, and have enough coverage. Many don’t.

- “Health insurance covers all costs.” It covers treatment, but not lost wages, future care, or pain and suffering — and it can demand reimbursement from your settlement later.

These are small misunderstandings that lead to big financial surprises. Florida’s motorcycle laws reward preparation knowing your coverage before a crash is half the battle.

Why Clermont and Central Florida riders should be extra careful

Central Florida’s roads can be unpredictable. Between tourist traffic, sudden weather shifts, and drivers unfamiliar with local routes, motorcycle crashes happen fast — especially around Clermont, Orlando, and the nearby highways.

Many riders here assume motorcycle insurance works just like auto insurance. It doesn’t. Florida’s system leaves most riders personally responsible for medical costs unless they’ve built proper protection into their policy.

The simplest fix is to review your policy before your next ride. Add MedPay or Uninsured/Underinsured Motorist coverage if you don’t have it. These optional add-ons cost far less than a single hospital visit — and they’re often what separates a covered recovery from crushing debt.

Frequently Asked Questions

Does motorcycle insurance in Florida cover medical bills?

Not automatically. Standard motorcycle insurance only covers damage you cause to others. To protect yourself, you need optional Medical Payments (MedPay) coverage or a strong health insurance plan.

What is MedPay and how does it work?

MedPay is an optional add-on that pays your medical bills after a crash, no matter who caused it. It can cover ambulance costs, emergency care, and rehab up to your policy limit.

If another driver caused my accident, will their insurance pay?

Yes, if the other driver carries Bodily Injury Liability (BIL) coverage. However, many Florida drivers either carry low limits or none at all. That’s why having Uninsured/Underinsured Motorist (UM/UIM) coverage is so important.

Can I use my health insurance for treatment after a motorcycle crash?

Absolutely. Health insurance will usually pay for emergency and follow-up care, but your insurer may later request reimbursement from any settlement or verdict you receive.

What if I don’t have MedPay or health insurance?

You can still pursue a claim against the at-fault driver or their insurer. An attorney can also help you find doctors who treat accident victims on a lien basis, meaning they get paid after your case settles.

Do I have coverage if I wasn’t wearing a helmet?

Yes. You can still recover compensation, though not wearing a helmet might reduce your claim’s value if the defense argues it worsened your injuries.

Is it worth getting UM/UIM coverage in Florida?

Definitely. Many crashes involve uninsured drivers. UM/UIM coverage steps in to pay your medical expenses, lost income, and pain and suffering when the at-fault driver can’t.

How long do I have to make a claim?

Florida law gives you two years from the date of the accident to file a personal injury claim. Acting quickly helps preserve evidence and strengthen your case.

What’s the best insurance setup for Florida motorcyclists?

At minimum, combine liability, MedPay, and UM/UIM coverage. This mix keeps you protected whether the crash is your fault, the other driver’s, or caused by someone without proper insurance.

Ready to talk to a Florida motorcycle accident lawyer who understands riders?

As we discussed in the start of the blog, that after a motorcycle crash, medical bills start piling up long before insurance companies act. Remember that you shouldn’t have to fight alone to prove what should be obvious — that your injuries deserve coverage and care.

Our Florida personal injury attorneys at MANGAL, PLLC help riders across Clermont, Orlando, and Central Florida untangle complex insurance claims, identify every coverage source, and recover the compensation they’re owed.

No hourly fees. No pressure. Just straight answers and experienced guidance from a team that rides the same Florida roads you do.

Healing and financial recovery start with knowing your rights — and acting before time runs out.