After a crash, Floridians discover how complicated our no-fault system really is. Florida car accident compensation depends on strict rules. If you do not see a doctor within fourteen days, your Personal Injury Protection, or PIP, benefits can be slashed.

Why is Florida’s system confusing—and how do you protect your money?

If you cannot prove your injury meets Florida’s permanent injury threshold, you may never recover money for pain and suffering. If an adjuster argues that you were more than 50 percent at fault, you could lose your right to any compensation at all.

At MANGAL, PLLC, our team has guided hundreds of Central Florida clients through this maze. We help you open your PIP claim properly, prove your injuries with the right medical evidence, and pursue the at-fault driver when Florida law allows.

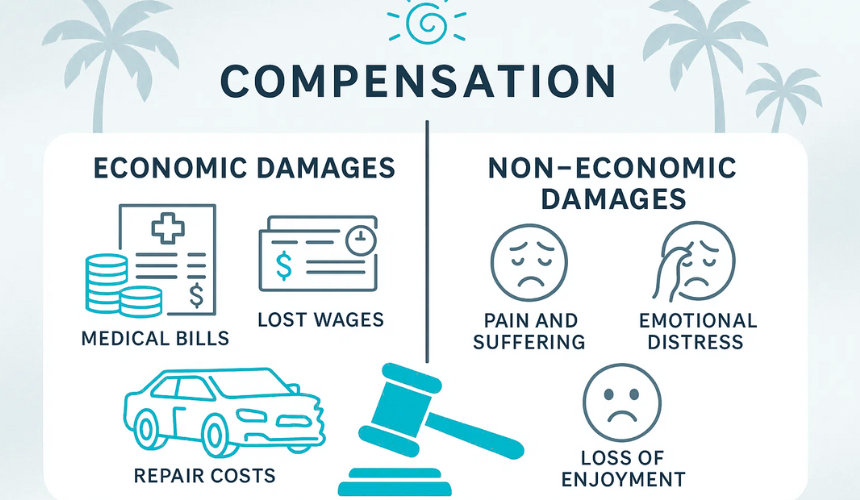

What compensation can you recover after a Florida crash?

Florida law recognizes two main buckets of damages: economic and non-economic. Economic losses are the dollars you can count. Non-economic losses cover the human side of harm.

You may claim:

- Medical bills now and in the future (hospital, therapy, diagnostics).

- Lost income and reduced earning capacity.

- Out-of-pocket costs: co-pays, meds, rides, childcare tied to treatment.

- Pain and suffering if you meet Florida’s injury threshold.

- Vehicle losses: repair or total loss, rental, loss of use, and diminished value in Florida.

Punitive damages are rare. They punish extreme misconduct, not ordinary negligence. Most cases aim to make you financially whole.

Bottom line: Track every expense from day one. Small receipts add up.

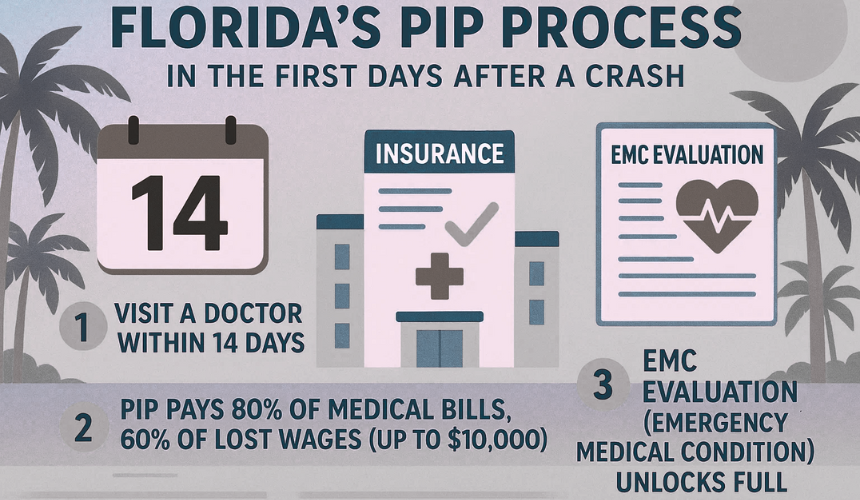

How does Florida PIP work in the first days after a crash?

Personal Injury Protection (PIP) pays first, no matter who caused the collision. Think of it as your starter coverage.

- PIP pays 80% of reasonable medical bills and 60% of lost wages, up to $10,000.

- A $5,000 death benefit applies.

- You must get initial medical care within 14 days of the crash. That’s the Florida PIP 14-day rule.

- Without an Emergency Medical Condition (EMC), PIP medical benefits cap at $2,500. With an EMC, you can access the full $10,000.

Where claims fail:

- Waiting too long to see a provider.

- Vague medical notes that don’t tie symptoms to the crash.

- Billing gaps and missed follow-ups.

Action step: Get evaluated within 14 days. Tell the provider it’s a motor-vehicle crash. Ask whether an EMC applies. Clean records protect your benefits.

When can you step outside no-fault and claim pain and suffering?

Florida limits non-economic damages unless you meet the injury threshold. You qualify if a doctor finds a permanent injury, you suffer a significant and permanent loss of an important bodily function, have significant and permanent scarring or disfigurement, or there’s death.

If you meet the threshold, you may pursue the at-fault driver for:

- Remaining medical bills and future care not covered by PIP.

- Full wage loss and loss of earning capacity.

- Pain and suffering, mental anguish, and loss of enjoyment of life.

Tip: Consistent treatment, specialist opinions, imaging, and functional testing help prove permanence. Gaps in care weaken value.

How does Florida’s modified comparative negligence change your payout?

Fault matters. Under modified comparative negligence in Florida, if you’re more than 50% at fault, you recover nothing. If you’re 50% or less at fault, your award drops by your percentage.

Simple example: Your case values at $100,000. You’re 20% at fault. Your gross recovery becomes $80,000.

What shifts that percentage?

- Photos, skid marks, and vehicle data.

- Witness statements and 911 audio.

- Dash-cam or surveillance footage.

- Seat belt use, distraction, and speed evidence.

Protect your percentage: Stick to facts in early calls. Don’t guess. Let evidence speak.

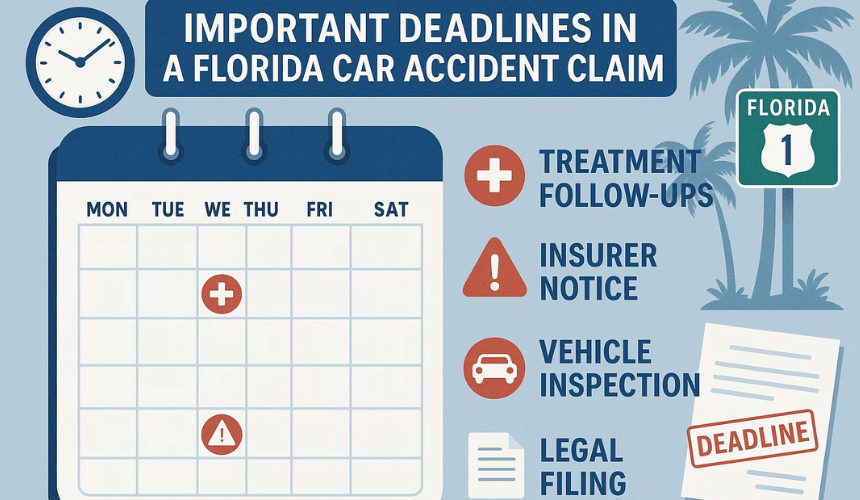

What deadlines could make—or break—your Florida claim?

Deadlines are tight. Most negligence injury claims now have a two-year statute of limitations. Property damage claims typically allow four years. Wrongful death claims carry two years from the date of death. Claims involving government vehicles may require early notice and follow special procedures.

Set your calendar now:

- Treatment follow-ups and referrals.

- Insurer notice and claim numbers.

- Vehicle inspection and estimates.

- Legal filing deadlines.

Miss a deadline and the claim can be barred. When in doubt, assume the shortest clock.

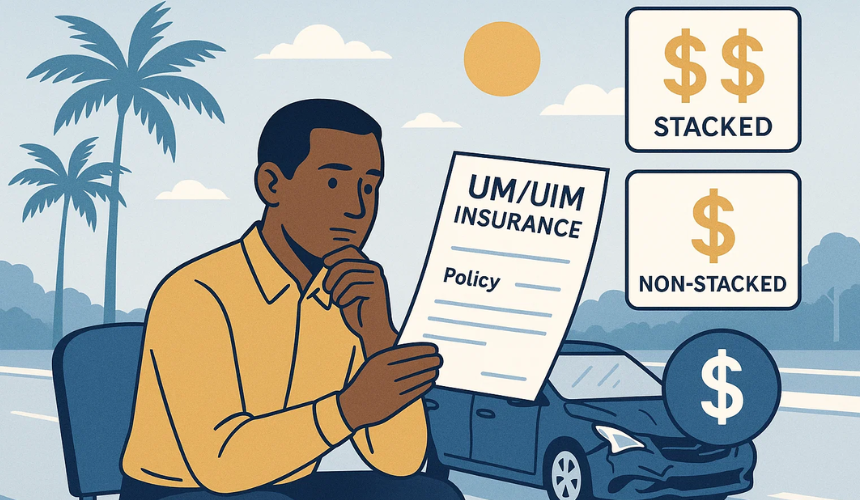

Where does recovery come from if the other driver is uninsured or underinsured?

Start with your policy. Look for UM/UIM Florida coverage (Uninsured/Underinsured Motorist). Insurers must offer UM, but many drivers reject it without understanding the risk. If you bought UM, it can mirror your bodily injury limits and step in when the at-fault driver has low limits—or none.

Stacking matters:

- Stacked UM may combine limits across vehicles on your policy.

- Non-stacked UM cannot.

- Your declarations page and any signed rejection form tell the story.

Also review rental coverage and property damage provisions. A diminished value claim in Florida may exist even after quality repairs.

How do you prove the full value of your losses?

Insurance pays what it can measure. Your job is to make the harm measurable. We build a clean record that ties every dollar to the crash and to your recovery timeline.

What records support medical damages the right way?

- ER, urgent care, PCP, and specialist notes that reference the crash.

- Imaging and testing (X-ray, MRI, EMG) linked to symptoms.

- Treatment plans, referrals, and prognosis.

- A future-care estimate for surgeries, injections, or therapy.

- A short pain journal tracking sleep, mobility, and daily limits.

How do you show lost income—especially if you’re self-employed?

- Employer letter confirming job duties, pay, and missed hours.

- Pay stubs or direct-deposit proof from before and after the crash.

- For gig workers: invoices, 1099s, calendar screenshots, and bank deposits.

- A simple summary of canceled shifts or lost contracts.

- CPA or bookkeeper letter where needed.

How do you support a Florida diminished value claim?

- Pre-crash photos and mileage.

- Repair invoices and parts lists.

- A reputable DV appraisal with market comps.

- Proof of options and trim level.

- Ads showing stigma against prior-accident vehicles.

Tip from MANGAL, PLLC: Keep everything in one folder. Date it. Small papers move big numbers.

What special rules apply to rideshare, commercial, and government vehicles?

Different vehicles mean different coverage maps. Limits can jump—or special defenses can appear. We navigate both.

How do rideshare accidents change the insurance picture?

- App on, no passenger: contingent liability may apply.

- En route or with a passenger: higher rideshare limits often trigger.

- Your PIP still pays first in Florida, but we stack coverages when allowed.

- Screenshots of driver status at the time help a lot.

How do commercial vehicle crashes affect compensation?

- Higher liability limits are common.

- Company policies, telematics, and training logs can prove fault.

- Spoliation letters preserve black-box data and camera footage.

- Early truck or fleet inspections can lock down evidence.

How do government vehicles and agencies alter your timeline?

- Strict notice rules and shorter clocks can apply.

- Sovereign immunity caps may limit payout unless a claims bill is pursued.

- You still build the same clean record—just faster.

What should you do in the first 72 hours—and the first 30 days?

Early moves set the tone. They also guard your Florida car accident compensation from avoidable cuts.

What belongs on your 72-hour checklist?

- Get checked by a qualified provider within 14 days. Sooner is better.

- Report the crash to your insurer. Keep it factual and brief.

- Photograph vehicles, the scene, and visible injuries.

- Gather witness names, numbers, and brief statements if possible.

- Schedule a body shop estimate and save the diagnostic report.

- Call MANGAL, PLLC for guidance before any recorded statement.

What should you do in the first 30 days?

- Follow every medical referral. No gaps in care.

- Track co-pays, pharmacy costs, rides, and childcare.

- Pull your declarations page to review UM/UIM Florida elections.

- Save all adjuster emails and claim notes.

- Keep social media quiet about the crash and your injuries.

- Document job impacts and missed opportunities.

How does a Florida lawyer maximize your net recovery and cut liens?

Gross settlement is not the finish line. Net recovery is what changes your life. That’s where strategy matters.

What strategies raise the number that matters—your net?

- Coordinating PIP, health insurance, MedPay, and UM/UIM to avoid double counting.

- Front-loading strong medical proof to meet the injury threshold.

- Fast evidence work to protect your percentage under modified comparative negligence.

- Pursuing diminished value in Florida with credible appraisals.

- Timing demand letters to medical milestones and MMI (maximum medical improvement).

- Negotiating medical liens and health plan reimbursements to put more in your pocket.

Why MANGAL, PLLC for Central Florida cases?

We’re local, hands-on, and reachable 24/7. Attorney Mangal personally oversees each file. You won’t be left in the dark. We fight for the truth—and for every dollar the law allows.

What common mistakes quietly cost Floridians money—and how do you avoid them?

A few missteps can sink value. Avoid these traps and your claim stays strong.

Which errors are most expensive?

- Waiting more than 14 days to see a doctor.

- Skipping follow-up visits or ending care early.

- Giving a detailed recorded statement without counsel.

- Posting about the crash or workouts on social media.

- Accepting a quick lowball and signing a broad release.

- Ignoring UM/UIM because “the other driver had insurance.”

- Forgetting diminished value or loss of use on the vehicle claim.

Simple fix: Pause. Call MANGAL, PLLC. Then act.

Questions Florida Drivers Often Ask After a Car Accident

Do I need to see a doctor within 14 days?

Yes, and it’s one of the most important steps you can take. Florida’s PIP law gives you 14 days to seek medical care. If you wait longer, your benefits may be cut to only $2,500 instead of the full $10,000. Even if you feel “okay” at first, get checked. Delayed pain is common after a crash.

Can I be paid for pain and suffering?

You can, but only if your injuries are serious enough under Florida’s permanent injury threshold. This means a doctor has to confirm a permanent injury, significant loss of function, or lasting scarring. Without that proof, the law limits you to economic damages like bills and lost wages.

What if the accident was partly my fault?

Florida follows modified comparative negligence. If you’re less than 50 percent at fault, you can still recover money, but your settlement will be reduced by your share of fault. If you’re found more than 50 percent responsible, you won’t be able to recover compensation. That’s why gathering good evidence early is so critical.

What if the other driver doesn’t have insurance?

This happens more often than you might think. If you purchased Uninsured/Underinsured Motorist coverage (UM/UIM), your own policy can step in to cover what the other driver cannot. It’s one of the most valuable protections you can have in Florida.

Can I ask for diminished value if my car was repaired?

Yes. Even after quality repairs, your car may be worth less simply because it has an accident history. A diminished value claim lets you recover that lost value. Having an appraisal or expert opinion makes your claim stronger.

Should I give a recorded statement to insurance?

Not before speaking with a lawyer. Adjusters are trained to ask questions in ways that can hurt your claim later. It’s safer to get advice first so you don’t say something that gets used against you.

How long do I have to file a lawsuit?

Most Florida car accident injury claims must be filed within two years of the crash. Property damage claims usually give you four years. Wrongful death cases also have a two-year deadline. The bottom line: the sooner you act, the better.

Do I really need a lawyer for minor injuries?

It depends, but it’s usually smart to at least talk to one. Injuries that seem minor in the first week can turn into long-term problems. A lawyer can review your situation, explain your options, and make sure you don’t settle for less than your case is worth.

What are the key takeaways for Florida drivers?

- Treat fast, document EMC, and open PIP benefits.

- Meet the injury threshold to pursue pain and suffering.

- Guard your fault share under modified comparative negligence.

- Calendar the two-year injury statute and other deadlines.

- Audit your policy for UM/UIM Florida and consider stacking.

- Prove every dollar with clean records and consistent care.

- Negotiate liens to lift your net recovery.

Ready to talk about your Florida Car Accident Case?

After a crash, the last thing you should worry about is battling insurance companies or figuring out confusing deadlines. At MANGAL, PLLC, we believe every case deserves personal attention, no matter the size. That is why clients across Central Florida trust us to handle the legal fight while they focus on healing.

Our firm has been voted the #1 injury firm in Central Florida and is proud to be 5-star rated on Google and Avvo. We are available 24/7 to answer your questions and give you the guidance you need right now.

Call us today at (352) 320-2913 or email Team@LawByYourSide.com for a free consultation. Whether your accident happened in Clermont, Orlando, or anywhere in Central Florida, we are ready to stand by your side and fight for the compensation you deserve.